Transform illiquid assets into tradeable digital tokens.

Build compliant and modular tokenization platforms powered by T-REX Engine for shorter time to capital markets.

Kreatorverse offers consulting services and white‑label platform development solutions specifically for asset managers, private funds, REITs, and institutional investors looking to lead in the onchain economy.

Tokenization is redefining how value is accessed, transferred, and owned. From real estate and credit to art and infrastructure, blockchain-based tokenization unlocks liquidity, expands investor reach, and enables programmable compliance for the future of finance.

Traditional asset markets are opaque & illiquid.

Tokenization unlocks global investor access; no settlement delays, intermediaries, or gatekeeping.

Institutional funds are already raising capital in minutes.

Tokenized investment vehicles are gaining traction; fuelled by investor diversity and cross-border accessibility.

Tokenized assets are a $19 trillion opportunity.

By 2033, real estate, private equity, and structured credit are expected to dominate the tokenization landscape.

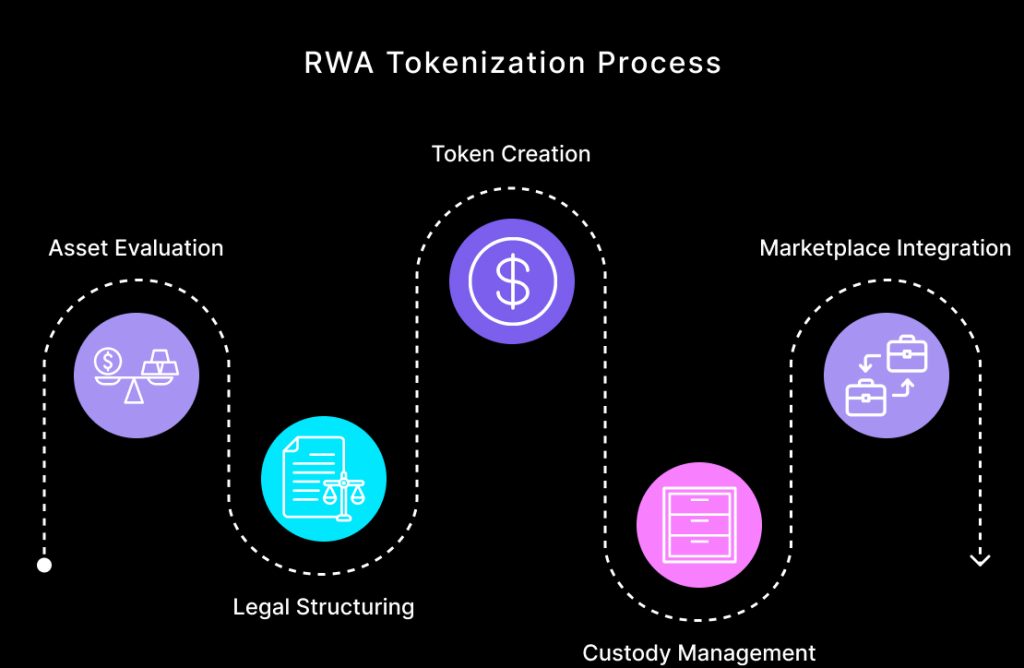

Unlock the full tokenization lifecycle from structuring and issuance to compliance and investor distribution. RWA Kreator combines deep Web3 infrastructure with institutional-grade advisory and product development.

From real estate to renewables, RWA Kreator is built for institutional-grade issuers aiming to digitize complex, yield-generating assets.

Tokenize commercial, residential, and rental-yielding portfolios.

Digitize receivables, loans, and structured credit instruments.

Enable fractional LP access, faster distribution, and governance.

Open capital markets for illiquid, ESG, and cultural assets.

Enable compliant secondary exits or redemptions.

Open up traditionally exclusive assets to broader participation.

Power programmable finance with real-world yield.

Quick answers to your payment related questions.

RWA tokenization is the process of converting physical or off-chain financial assets; such as real estate, private equity, credit, or commodities; into digital tokens on a blockchain. It enables fractional ownership, enhances liquidity, and unlocks access to global capital, especially as institutions shift toward blockchain-based capital markets.

RWA Kreator supports the tokenization of:

Yes; with the right structuring. RWA Kreator provides jurisdiction-specific advisory to ensure full compliance with securities laws, using legal wrappers such as SPVs, trusts, or DAOs. We work with legal counsel and regulators in regions like the US, EU, UAE, Singapore, and India.

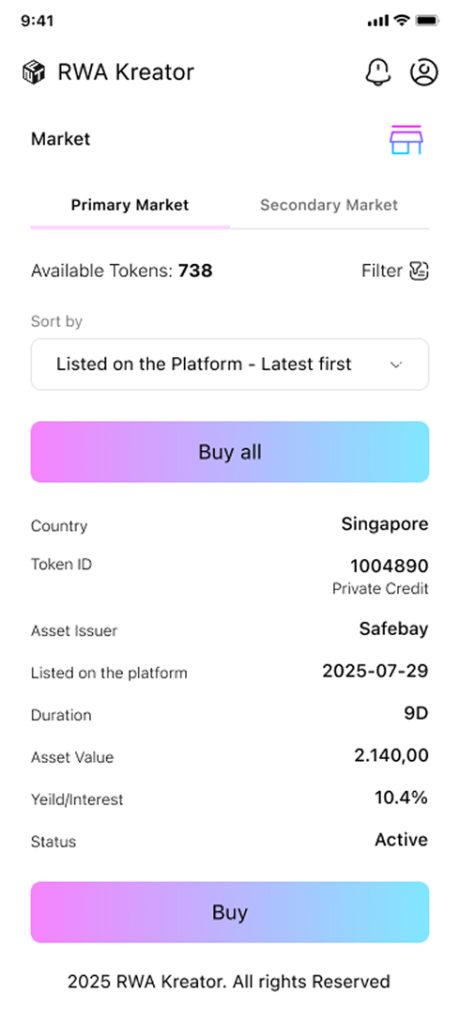

No. The platform is built for asset managers, fund admins, and investment teams; not developers. Our dashboard allows you to issue, manage, and distribute digital assets through an intuitive no-code interface, with smart contracts and infrastructure handled in the background.

We support widely adopted, regulatory-compliant standards including ERC-1400, ERC-3643, and ERC-20 (with permissioning), as well as custom schemas for more complex fund structures or wrapped securities. Deployment can be done on Ethereum, Polygon, Avalanche, and more.

The platform comes with built-in KYC/AML verification, investor whitelisting, and geographic restrictions. Smart contracts are permissioned, ensuring only verified investors can interact with tokens. Full audit trails and exportable compliance reports are provided for regulators or fund admins.

Yes. Whether you’re launching a new fund, securitizing a new property, or retrofitting an existing asset pool, RWA Kreator can structure and tokenize it. We support onboarding of legacy assets held in SPVs, trusts, or corporate entities.

Yes. We support integration with compliant secondary platforms, including ATSs and security token exchanges. For private networks or OTC deals, we also build custom peer-to-peer trading interfaces, allowing investor exit without violating transfer restrictions.

Our clients include:

It starts with a discovery call where we assess your asset class, jurisdiction, investor type, and technical needs. We then scope the project (typically 6–8 weeks for MVP), set up legal wrappers, issue the token, and deliver a live, branded tokenization platform with compliance features.

We’ll help you spot the builders who are solving real-world problems;

with the tech, timing, and traction to win.