On January 10, 2024, Bitcoin received the biggest regulatory recognition—fourteen years since its launch—when the U.S Securities and Exchange Council (SEC) approved spot Bitcoin Exchange Traded Funds (ETFs) from 11 Asset Management Companies*. It’s been a long time coming; 10 years, in fact. The Bitcoin ETF approval marks an acknowledgment and acceptance of Bitcoin, and by extension cryptocurrency, as a value-holding asset class.

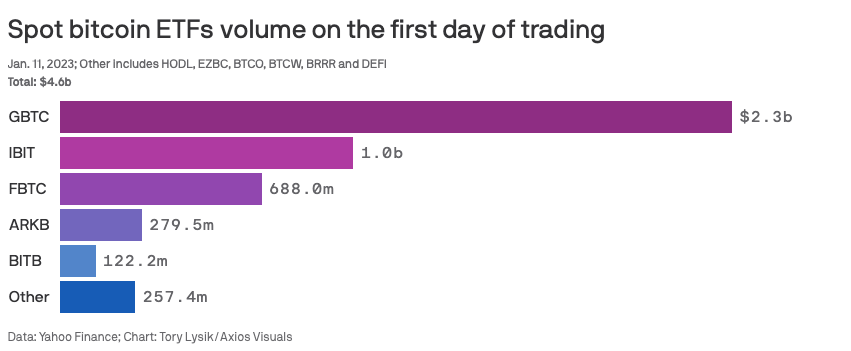

The landmark decision led to an influx of investor activity in the crypto market by both retail and institutional investors. Around $4.6 billion was traded on the first day of the spot Bitcoin ETF trading. To put things in perspective, the inflow on day one of Gold ETF trading stood at a billion dollars.

Firstly, what is a Bitcoin (BTC) ETF?

Where a traditional ETF hinges on a basket of securities consisting of stocks, bonds, commodities, or other financial assets that track global markets, a Bitcoin ETF does the same, with an important distinction – the underlying asset is the digital token.

Typically, ETFs are popular with retail investors because of their low-cost fees, easy access to various assets, and self-management of portfolios.

Why did we need the BTC ETF approval?

Bitcoin ETFs make it easier for investors to enter the crypto market and add another asset class to their investment portfolios. With shares of the ETF, investors can indirectly own a ‘bit’ of a Bitcoin minus the complexities.

- Bitcoin ETF is not an investment directly into the cryptocurrency but an indicator of its value

- Investors wouldn’t need a crypto wallet since they are not holding the Bitcoin directly.

- They would also not have to register with a crypto exchange and maintain an account for their investment.

With Bitcoin ETFs, one can expect the elimination of the risks associated with self-storage, potential hacks or fraud, and legal uncertainties. The ETFs allow for convenient and regulated entry for new-to-crypto or those facing regulatory restrictions when directly investing in cryptocurrencies.

While this is phenomenal news for Bitcoin, it has implications beyond the singular token – the potential to impact financial regulations for the entire crypto ecosystem, paving the way for a future where decentralization of finance is not an exception but the rule.

Here’s how Bitcoin ETF approval can impact the DeFi market

Institutional investors want a piece of the pie

The Bitcoin ETF approval has opened the gateway—a regulated one—to a $100 trillion market of institutional participation. A golden ticket for the crypto economy, it can pave the way for an era of mainstream acceptance of Bitcoin and other cryptocurrencies and DeFi products.

- The influx of capital might take liquidity in the Bitcoin market to new highs, which could benefit DeFi platforms and their associated tokens. The legitimacy these mainstream financial players confer could lead to a domino effect, where traditional investors consider other cryptocurrencies and DeFi projects more viable.

- Bitcoin ETFs could open up Bitcoin investments to traditional funds (think 401ks, IRAs, pensions) in the U.S. Therefore, we expect the gap between the TradFi (traditional finance) and DeFi worlds to narrow.

There will be more stability and less volatility with Bitcoin (and crypto) price

The influx of institutional investors through Bitcoin ETFs is expected to bring more stability to Bitcoin’s price. As institutional funds are generally considered ‘smarter money’ that makes more calculated and less speculative investments, their involvement could reduce Bitcoin’s price volatility. This reflects the stabilizing effect institutional investors have had in other asset classes.

For DeFi traders, Bitcoin ETFs present an opportunity to broaden their investment portfolios and mitigate the risks typically associated with holding cryptocurrencies directly.

We will witness mainstream retail adoption of crypto and, eventually, DeFi

What’s the biggest challenge to Bitcoin investment?

It’s its accessibility.

The volatility and complexity of cryptocurrencies, the threat of hacks, the responsibility of managing cryptographic keys, and the lack of custodial services often discourage mainstream investors from dabbling in crypto. With Bitcoin ETFs, investors have an easier route – safe exposure to Bitcoin without buying, storing, or managing it directly.

Moreover, household names like BlackRock and Fidelity supporting Bitcoin ETFs bring assurance and security at the governmental and institutional levels. These firms perform extensive due diligence and would not support any asset unless thoroughly vetted and demanded by clients. This backing provides small investors the confidence to dip their toes into deFi.

Robust DeFi-centric regulations will come to be

As the bigwigs of TradFi get their crypto fix, one thing is evident – the need for clear, fit-for-purpose regulations for the digital asset ecosystem.

- Approval of Bitcoin ETFs heralds the institutionalization of cryptocurrency. This could expand its accessibility in a simpler, more regulated way, leading to a broader acceptance and integration of digital assets in mainstream financial systems. The influence on regulatory frameworks for DeFi is thus imminent.

- A more robust regulatory framework for cryptocurrencies and DeFi products could increase investor confidence, further merging the tradFi and deFi sectors

In fact, the Financial Stability Board (FSB) has outlined its focus for 2024, emphasizing the “effective implementation of the global regulatory and supervisory framework for crypto-asset activities and markets.”

Closer to home, regulatory authorities in India are expected to monitor ETF activities closely in the coming period. The structural variances between the ETF markets in India and the U.S. are significant, with India’s market being more retail-oriented. Therefore, when approving ETFs, there’s a stronger emphasis on consumer protection, a concern frequently highlighted by the RBI.

Expect more DeFi-enabled financial innovations and projects

Exciting times await as we’re likely to see a vibrant array of crypto-based financial products springing up. This includes potential Ethereum ETFs, DeFi funds, and even indexes for something as novel as NFTs! The door to a diverse investment playground has been opened, where financial portfolios can dance across a spectrum of crypto-related instruments.

Bitcoin is like the big sibling whose every move ripples across the crypto family. When Bitcoin strides confidently into the TradFi world with an ETF, the move could rev up activities across altcoins, DeFi, and the emerging Web3 sectors. Companies in these realms might find themselves in a spotlight they’ve never had before.

Moreover, the buzz around Bitcoin ETFs could have a spill-over effect, drawing media and investor attention to the wider crypto market. Bitcoin’s ETF star power could pique curiosity in Ethereum and other blockchain-based projects, potentially fueling investment and innovation in DeFi.

There will be greater acceptance of the technology inherent to crypto

The approval of Bitcoin ETFs helps in the wider acceptance of blockchain technology, the foundation of cryptocurrencies, by bringing it into the mainstream investment sphere. This recognition by traditional financial markets legitimizes blockchain as a credible and valuable technology. Real-world applications of blockchain technology extend beyond cryptocurrencies and include:

- Supply chain management: Blockchain enhances transparency and traceability in supply chains, ensuring the authenticity of products and reducing fraud

- Voting systems: It can provide secure, transparent, and tamper-proof voting mechanisms, enhancing the integrity of electoral processes

- Healthcare: Blockchain can securely store and share patient records, improving data accuracy and accessibility for healthcare providers

- Smart contracts: These are self-executing contracts with the terms of the agreement directly written into code, providing automation and reducing the need for intermediaries

- Identity verification: Blockchain can offer a more secure and efficient way to manage digital identities, reducing the risk of identity theft and fraud

The time is ripe for TradFi and DeFi movers and shakers to leap into projects they’ve been ideating. The approval of the Bitcoin ETF ushers a new era, bridging the gap between conventional finance and the burgeoning world of digital assets. This pivotal moment signifies acceptance and an invitation to innovate and lead in Web3.

With the traditional market embracing Bitcoin, the path has been paved for groundbreaking ventures in this realm. The opportunity to be at the forefront of this technological revolution is now seizing the potential of Web3 to redefine finance and business.