Framing and implementing robust Web3 regulations may seem daunting and time-consuming, not to mention the reliance on policymakers’ bureaucracy. Still, it’s one of the main tools in our arsenal to build a future rooted in the mainstream adoption of Web3—be it for finance via DeFi or other sectors. I mean, the applications are endless, no?

Web3 was a world of boundless possibilities colliding with uncertainty and regulatory ambiguity.

However, as the revolutionary potential of Web3 technologies and decentralized finance (DeFi) continues to captivate the world, a pivotal shift is underway in the regulatory landscape. Governments (previously bystanders) and regulatory bodies across the globe are taking proactive steps to establish clear guidelines and frameworks, recognizing the need to foster innovation while ensuring consumer protection and financial stability.

This proactive approach signified a profound shift in the global narrative surrounding Web3 and DeFi. Countries are now actively embracing the opportunities presented by these emerging technologies, acknowledging their potential to drive financial inclusion, enhance operational efficiency, and unlock new revenue streams.

Web3 Regulations across the World

Payment Services Act (Singapore)

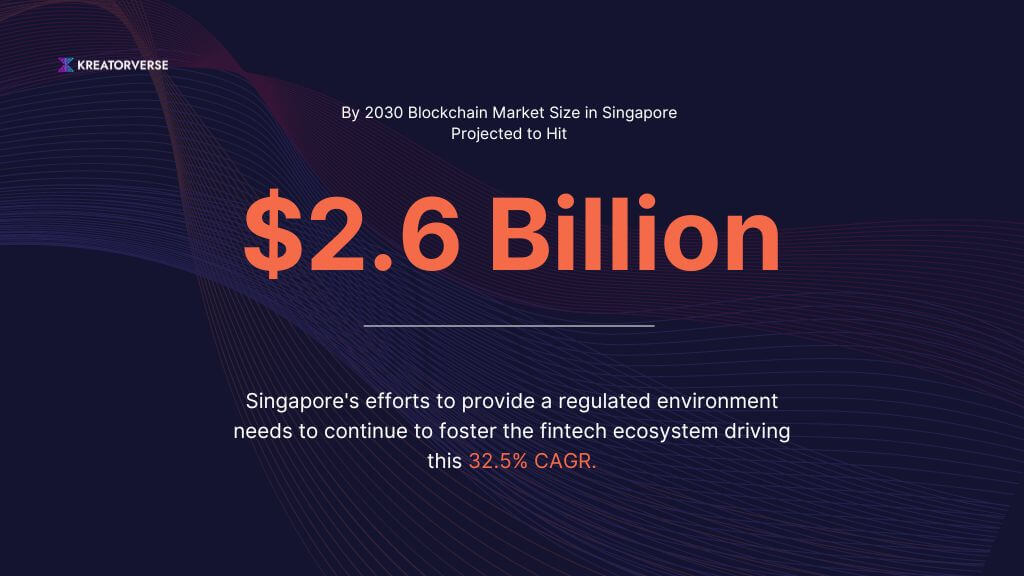

The blockchain industry in Singapore has been experiencing exponential growth, as evidenced by projections from the Future of Services report. They expect the global blockchain market to soar from U.S. $212 million to a staggering U.S. $2.6 billion by the end of 2030, representing a remarkable compound annual growth of 32.5%.

Consulting firm PwC further strengthens the growth trajectory, finding that 82% of surveyed executives in Singapore have blockchain initiatives underway. Of these, 13% have already been launched into the market.

Singapore has been at the forefront of fostering a crypto-friendly environment and encouraging blockchain companies to thrive. Therefore, in 2020, they introduced the Payment Services Act to provide a robust regulatory framework for digital payment services, including cryptocurrency dealings.

Consequently, entities dealing with cryptocurrencies are required to be licensed by the Monetary Authority of Singapore (MAS), comply with stringent anti-money laundering (AML) measures, and counter the financing of terrorism (CFT) measures. Additionally, the MAS has established a regulatory sandbox, allowing companies to experiment with innovative financial products and services within a well-defined regulatory environment.

The Payment Services Act has played a pivotal role in attracting numerous cryptocurrency and blockchain companies to Singapore, positioning the city-state as a leading hub for Web3 innovation. By providing a clear and supportive regulatory framework, Singapore has created an environment that fosters technological advancements while maintaining consumer protection and financial stability.

Dubai Virtual Assets Regulatory Authority (VARA)

Dubai, known for its forward-thinking approach, has taken a bold step by establishing the Dubai Virtual Assets Regulatory Authority (VARA) in February 2023 to regulate the virtual assets sector. VARA has introduced a comprehensive regulatory framework covering various aspects of the virtual asset industry, including issuance, listing, trading, and custody, to ensure compliance with global standards.

Recent research by Crypto Oasis Ecosystem states that the country hosts over 1,450 active Web3 firms, employing close to 7,000 individuals. This data alone highlights the strength of Dubai’s growing Web3 ecosystem.

Therefore, by framing regulations for the virtual assets sector through VARA, Dubai aims to provide clarity and certainty to businesses in the Web3 space, fostering a secure environment for investors and consumers.

VARA’s regulatory framework addresses critical areas such as investor protection, market integrity, and anti-money laundering measures. It also includes provisions for establishing a virtual asset service provider regime, further strengthening the regulatory oversight in the emirate’s burgeoning virtual asset ecosystem.

Markets in Crypto-Assets (MiCA) Regulation (European Union)

The European Union (E.U.) has been actively working on harmonizing crypto regulations across its member states. In 2022, the E.U. proposed the Markets in Crypto-Assets (MiCA) regulation to create a comprehensive regulatory framework for crypto-assets.

MiCA addresses critical consumer protection, market integrity, and financial stability issues. It includes provisions for licensing and supervision of crypto-asset service providers, issuance and trading of crypto-assets, and disclosure and transparency requirements. Once implemented, MiCA will provide a consistent and harmonized regulatory approach across the E.U., facilitating cross-border operations and promoting innovation in the Web3 space.

The MiCA regulation is designed to balance fostering innovation and mitigating risks associated with crypto-assets. By establishing a harmonized regulatory framework, MiCA aims to provide legal certainty for businesses in the crypto industry within the E.U.

Responsible Financial Innovation Act (United States)

Given the United States’ significant influence in driving innovation and investment in the blockchain industry, they must establish clear regulatory frameworks.

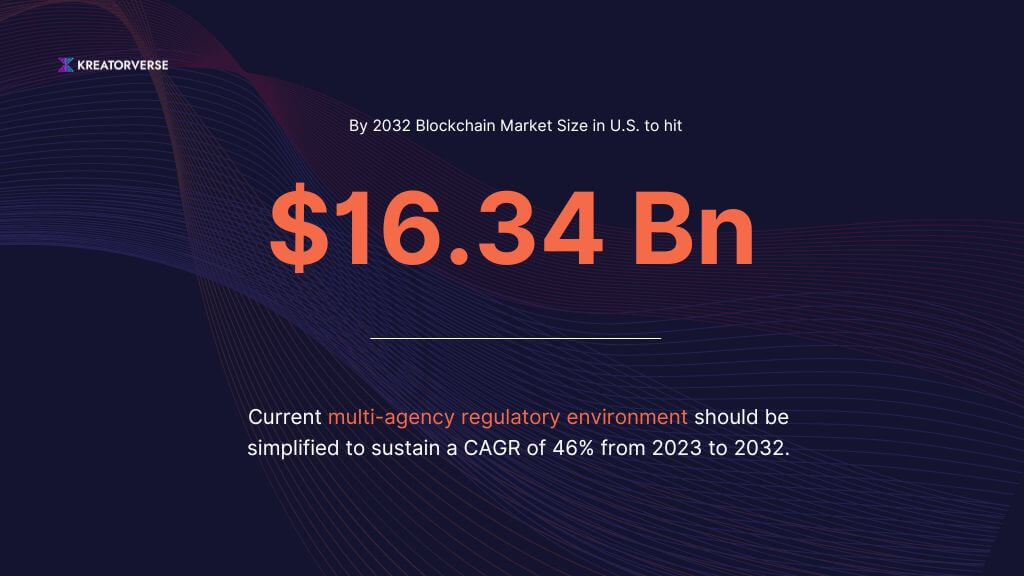

Research shows that the Web3 market in the U.S. is projected to reach a whopping $16.34 Billion by 2032. Moreover, blockchain and cryptocurrency startups raised funding of $1.9 Billion in the first quarter of 2024.

Yet the regulations, particularly for cryptocurrencies and DeFi, have been characterized by a patchwork of federal and state-level initiatives. Senators Cynthia Lummis and Kirsten Gillibrand introduced the Responsible Financial Innovation Act in June 2022 to address this fragmentation.

This bipartisan bill aims to create a regulatory framework for digital assets by defining the roles and responsibilities of various federal agencies, clarifying the treatment of digital assets, and establishing rules for stablecoins and consumer protection. The Act seeks to provide greater clarity and develop a comprehensive framework for the crypto industry in the United States.

One key provision of the Responsible Financial Innovation Act is establishing a new regulatory framework for digital asset products and services, including cryptocurrencies, stablecoins, and other tokenized assets. This framework promotes responsible innovation while ensuring consumer protection and maintaining financial stability.

Additionally, the Act proposes creating a new regulatory category for decentralized autonomous organizations (DAOs) and establishing rules for the taxation of digital assets, addressing a long-standing ambiguity in the industry.

Navigating the Web3 Regulations Landscape: Opportunities for Fintech Companies

The collapse of FTX, once the second-largest crypto exchange, sent shockwaves through the industry and intensified regulatory scrutiny worldwide. This event illustrated the urgent need for robust regulations and compliance measures to safeguard investors and maintain the integrity of the crypto market. It also highlighted several crucial areas that require immediate focus: transparency, risk management, regulatory compliance, and investor protection.

As the regulatory landscape for cryptocurrencies and decentralized finance (DeFi) continues to evolve, fintech companies have a unique opportunity to position themselves at the forefront of the Web3 revolution by proactively navigating it. Operating in a regulatory vacuum was never viable, and the FTX collapse is a stark reminder of this.

By staying informed about regulatory developments and actively engaging with regulatory bodies, fintech companies can:

- Enhance Compliance and Risk Management

Implementing robust compliance frameworks and risk management strategies in alignment with the latest regulations is crucial. As the FTX collapse highlighted, lack of transparency and inadequate risk management can have severe consequences.

Fintech companies should prioritize establishing policies and procedures for consistently maintaining and protecting customer assets, including holding sufficient insurance coverage. Additionally, as regulations like Singapore’s Payment Services Act mandate, you must implement stringent anti-money laundering (AML) and know-your-customer (KYC) protocols and systems to detect and report suspicious activities.

- Drive Innovation

Regulatory sandboxes and innovation hubs present a valuable opportunity for fintech companies to drive innovation in crypto and DeFi. For instance, the Monetary Authority of Singapore (MAS) has established a regulatory sandbox, allowing companies to test innovations in finance in a controlled environment.

By leveraging these hubs for Web3 regulations and innovation, fintech companies can:

- Validate their concepts and business models live, gathering valuable feedback and data to refine their offerings.

- Collaborate with regulators to address potential risks and compliance issues before launching to the broader market.

- Gain a competitive edge by being among the first to bring innovative solutions to the market while ensuring regulatory compliance from the outset.

- Attract investors and partners by demonstrating their ability to navigate the regulatory landscape and mitigate risks effectively.

Moreover, participation in these controlled environments can be a stepping stone for fintech companies to obtain the licenses and approvals required for mainstream market entry, accelerating their time-to-market and providing a competitive advantage.

- Facilitate Cross-Border Operations

Initially, Web3 was like a sector with vastly different rules in every country, much like traveling without a standardized passport system. Companies need help navigating a maze of conflicting requirements, making cross-border expansion daunting.

However, as regulatory frameworks become more harmonized across jurisdictions, fintech companies can leverage these developments to expand their operations globally, reach new markets, and capitalize on emerging opportunities.

- Contribute to Shaping the Regulatory Landscape

Fintech companies can provide valuable insights and develop well-informed and balanced regulations by collaborating with industry associations, regulatory bodies, and other stakeholders. For example, the SEC’s approval of a Bitcoin ETF in the United States established a precedent for regulating Bitcoin-related investment products. It may pave the way for other cryptocurrency-based financial instruments.

Additionally, while some countries like the U.S. have pursued a unique path characterized by case-by-case enforcement actions and attempts to fit crypto regulation into existing financial frameworks, fintech companies can engage with regulators to shape a more cohesive and supportive regulatory environment. They can proactively engage in advocacy efforts, directly communicating with policymakers, sharing their insights, and advocating for regulations that foster innovation while ensuring consumer protection and financial stability.

Working with and for Web3 Regulations

Embracing Web3 technologies and decentralized finance can unlock new revenue streams, enhance operational efficiency, and provide a competitive edge. However, even with regulations being set, Fintech companies must partner with experts who deeply understand the blockchain industry’s regulatory landscape and underlying technologies. It helps you implement secure and compliant solutions and seize the opportunities presented by the Web3 revolution.

Kreatorverse provides Web3 native offshore teams to design, develop, and deploy new use cases based on embedded Web3 features. With our extensive knowledge and experience in the blockchain industry, we accelerate the Web3 transformation of fintech companies. Our tailored APIs bridge the gap between centralized and decentralized finance while decreasing your time to market by a whopping 50%. Book a call with us, and let us help you build future-proof offerings for the new age of finance.