Financial leaders need industry mavens, niche developer skills, and informed strategists for asset tokenization. These experts must look past the hype and into real-world applications to help you reap the benefits of tokenization.

Since the 2008 debut of the Bitcoin whitepaper, Web3 has been the subject of many developments and some downfalls. In the initial days, buzzwords like Move-to-Earn, the Metaverse, and GameFi quickly followed the blockchain talk. While some projects were successful or labeled promising, others faded – as buzzwords do.

2024 is different. It began with the launch of spot Bitcoin ETFs on the U.S. market. For the first time, institutional investment in decentralized finance took place at scale. This move signaled that digital assets and digital representations of tangible assets aren’t mere trends. They’re a reality and are ushering in the much-needed decentralization of finance.

Even before the Bitcoin ETF approval, there was (and continues to be) a growing interest in tokenization, particularly RWA. The Full-Year 2023 & Themes for 2024 report from Binance echoes this – “The tokenization of RWAs presents a strong use case for blockchain technology. By bringing off-chain assets onto the blockchain, RWA tokenization allows for greater transparency, increased efficiency, and a new realm of possibilities regarding composability and potential use cases.”

Asset tokenization can potentially reshape finance – lending, credit, and debt markets in particular. Total value locked (TVL) in RWAs had nearly doubled in 2023, surging from $1.44 billion to $2.5 billion as of September 30, 2023.

In 2030, the market size of tokenized assets is expected to reach US$16 trillion. This will account for 10% of global GDP by the end of the 2030s, a significant increase from $310 billion in 2022.

Boston Consulting Group

At $16 trillion, tokenized assets are a fraction of the current total global asset value, estimated at $900 trillion.

Is this just hype? Or is all the talk about tokenization real, including its impact on the transformation of finance as we know it? Also, why should you—as a financial leader, a business owner, or an investor—care?

First things first.

What is Asset Tokenization?

Tokenization is converting an asset into digital form using distributed ledger technology. Here, assets—physical and intangible—are represented by a digital token. The token’s value is directly linked to the underlying asset’s value. The token holder has legal ownership of that asset. The asset is now in a tradable digital form on the blockchain, making the transfer of ownership easy yet secure.

What is RWA Tokenization?

Unlike intangible assets, RWA stands for Real World Assets. When an asset is tokenized, it becomes more liquid, divisible, and accessible to many. While any real-world asset can be tokenized, tokenizing assets with no value in the secondary market doesn’t make much sense.

NFT—a nonfungible token —is an excellent example of tokenization in the art and entertainment spaces. When tokenized, the asset—arts, collectibles, concert tickets, loyalty programs, sports teams, Jack Dorsey’s first tweet—cannot be replicated, a digital proof of ownership people can buy and sell.

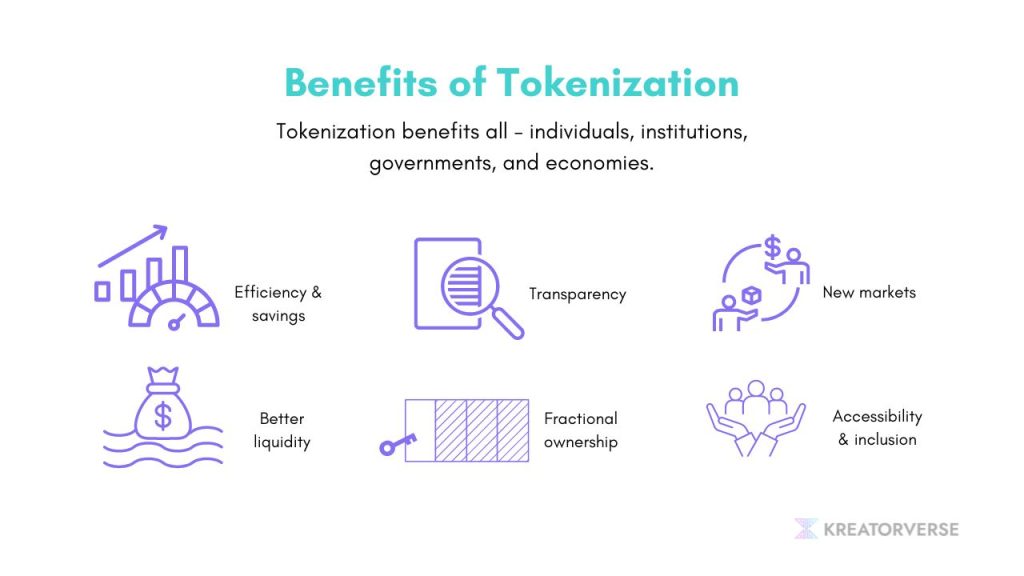

The benefits of real-world and digital assets tokenization are multifold.

Asset tokenization increases liquidity and offers fractional ownership.

By leveraging blockchain technology, tokenization converts illiquid or hard-to-liquidate assets into tradable ones. Investors can buy and sell smaller sections of an asset. This increases market participation and opens investment opportunities that were previously out of reach.

Liquidity, liquidity, liquidity. If we have learned anything from the past few years, liquidity is king, and asset tokenization accelerates this capability.

Aaron Rafferty, CEO – StandardDAO

Tokenization can result in near-lightning fast settlements.

In money market fund redemptions, tokenization will enable transaction completions in just a few minutes. This is an unignorable improvement over the current T+2 settlement period. A shorter settlement time can mean substantial savings. This is particularly beneficial during high-interest-rate periods.

Tokenization improves transparency and security.

Each transaction on the blockchain is recorded for an immutable and auditable record of ownership and transfers. The reliance on intermediaries is eliminated while reducing the risk of fraud or manipulation.

Asset tokenization reduces barriers to entry for investors.

Private equity investments have historically been limited to institutional investors. Tokenization, with its lowered transaction costs, democratizes investment opportunities. Previously illiquid assets, such as real estate, fine art, and intellectual property rights, can now be accessed and traded by a broader range of individuals, resulting in financial inclusivity and portfolio diversification.

Say hello to stable collateral in DeFi.

When real-world assets—traditionally accepted collateral—make their way into decentralized networks, the security and stability, and thereby the acceptance of the DeFi ecosystem, is improved. The once lengthy and time-consuming tradFi process of lending and clearing is simplified and streamlined.

For future-forward enterprises and startups alike, tokenization is non-negotiable.

Tokenization, including Real World Asset (RWA) tokenization, is pivotal to the digitization of finance and the future of investing. Hailed as the catalyst for a financial revolution, it bridges the gap between traditional assets and, by extension, trade and defi.

How so?

Tokenization offers benefits that traditional financial systems cannot. Currently, ownership records of most private assets are via outdated, centralized systems. When real-world assets are digitalized at scale, efficiency and connectivity are enhanced through a digital, trust-based network. This addresses the limitations and systemic biases within traditional economic models.

- Blockchain’s 24/7 operations and data availability result in operational cost savings. This is especially useful for assets like corporate bonds, where issuing and servicing are manual and error-prone.

- Transaction settlement is faster and has more automation, translation, and cost savings.

- Unlock new and underserved markets. By streamlining operationally intensive manual processes, servicing smaller investors can become an economically attractive proposition for financial service providers. Tokenization also brings fractional ownership of assets that historically had high investing thresholds, making them accessible to many. Barriers to entry are reduced.

- Enhanced transparency enabled by smart contracts results in an immutable record of credits, even as trading takes place.

- Agile infrastructure powered by blockchains’ open-source nature makes it cheaper and easier to build than tradFi infrastructure.

Institutions are already leveraging digital and real-world asset tokenization.

Thanks to the lucrative dollar-value pie of tokenized assets, several multinational financial institutions launched tokenization products in 2023. This is proof of growing institutional interest in blockchain technology.

The next generation of financial markets and securities will be built on the tokenization of assets.

Larry Fink, CEO – Blackrock

TradFi giants, including BlackRock, HSBC, Fidelity, Goldman Sachs, BNY Mellon, JP Morgan, and UBS, are exploring blockchain technology to tokenize a wide range of assets, extending their use beyond operational purposes.

- Having already created tokenized funds, JP Morgan is expected to introduce more complex financial instruments soon. They are also incorporating assets from novel revenue sources such as private credit.

- HSBC plans to launch a service for digital asset custody targeted at institutional clients, focusing on tokenized securities issued on external platforms, including those that support private and public blockchain-based tokenized bonds or structured products.

- Governments in Hong Kong and Thailand are facilitating tokenization technology for tangible assets to generate new income streams while cutting costs.

- In the U.K., Switzerland, and Japan, regulatory bodies are eyeing the potential of tokenization in markets such as asset management, foreign exchange, and fixed income.

A caveat is necessary before you embrace tokenization with arms wide open.

The success of asset tokenization projects hinges on trusted, proven, and experienced talent.

Is tokenization hype? Some of it, yes.

To most, the allure of tokenization often overshadows the truth. Tokenization projects start with a viable idea and a goal. But as the concept grows roots and wings, startups and enterprises realize that they may be lacking in certain areas that are crucial for

- Product design and development

- Go-to-market strategy

- Knowledge of tokenization and its foundational premise

Shortcomings in any of the above can result in execution failure. Beyond this, there are the risks – of security and compliance non-adherence.

You need the perfect Web3 partner for your asset tokenization ambitions to materialize.

How do you identify the right Web3 partner for asset tokenization projects—one with niche skills, domain expertise and knowledge, and a proven track record of delivering successful asset tokenization missions for others? Moreover, the partner must be able to look past the hype and work with the realities.

Consider FUCapital, which is tokenizing fixed-income assets for its lending/borrower platforms, or Polytrade, a leading innovation in trade financing through the tokenization of invoices.

Founded by consultants, Zedta is changing the game with proof-of-skill tokenization, while Mina Blockchain is doing the same with a different approach – tokenization of zero-knowledge proof (ZPK).

All gained 10x in terms of project delivery value by utilizing Kreatorverse’s tech partnership package. This enabled them to successfully ship asset tokenization projects with

- 50% reduction in time to go to market

- 50% reduction in design and development costs

- No risk of legal and security non-compliance

The zero-compromise-on-quality execution, end-product shipment, go-to-market strategies, and continued development support, training, and mentoring are the hallmarks of our work at Kreatorverse. This builds a deep trust between us and our clients. They then become advocates for us while continuing to engage us with more complex projects in tokenization across assets.

Bring your asset tokenization idea to life

Future-forward enterprises across the globe trust Kreatorverse

for all things tokenization, deFi, and blockchain.

The digital revolution impacts industries without discrimination, and financial institutions should capitalize on this revolution with blockchain technologies. Despite the hype and the skepticism, asset tokenization is paving the way for Web3 maturity and acceptance. With this comes wealth democratization, and financial inclusion.

The question is, will you be at the forefront of this financial revolution?