It’s incredible that we get to witness one of the most powerful industries in the world begin to handshake with one of the most powerful technologies. We are witnessing a paradigm shift for the financial industry as it meets the endless opportunities that Web3 offers.

Been hearing the buzzword quite a lot, but still need clarification about what exactly Web3 is. Read our blog to understand what, how and why the shift to Web3 is inevitable here. This will also help you understand a bunch of new terms we are discussing below – like RWAs, NFTs, Tokenised assets, DeFi and more.

Just like how AI has vastly expanded the boundaries of what is and what could be, Web3 and digital currency will surprise you even more in this aspect. Web3 brings to the table a decentralized, user-centric approach that is sure to transform the current traditional banking and financial systems.

The Revolution

What does Web3 offer the banking and finance industry? How is it beneficial, and what does it mean for the industry’s future? I know the hundred thoughts racing on your mind right now, but worry not—we’ll discuss each of them proceeding with the understanding that you’ve either read the blog above or have done your fair share of research on the Web3 jargon!

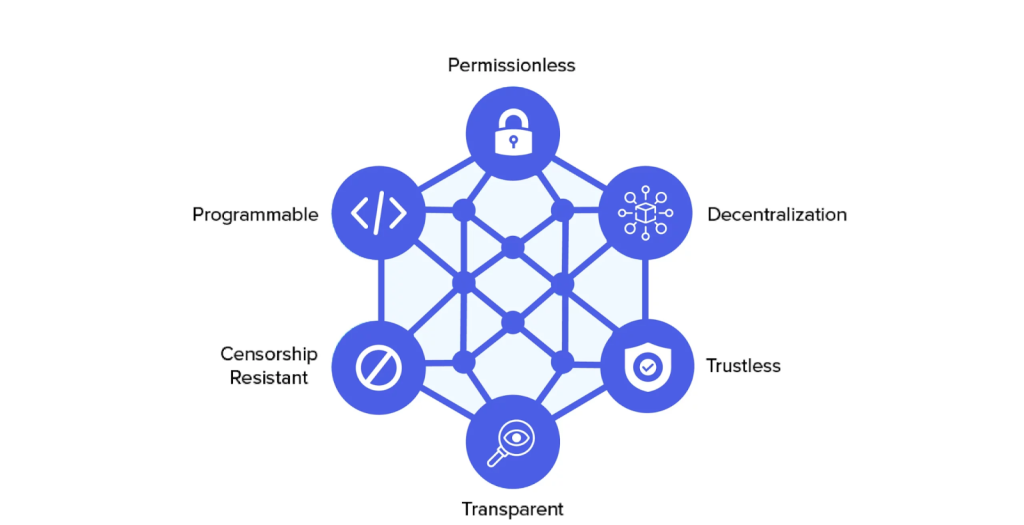

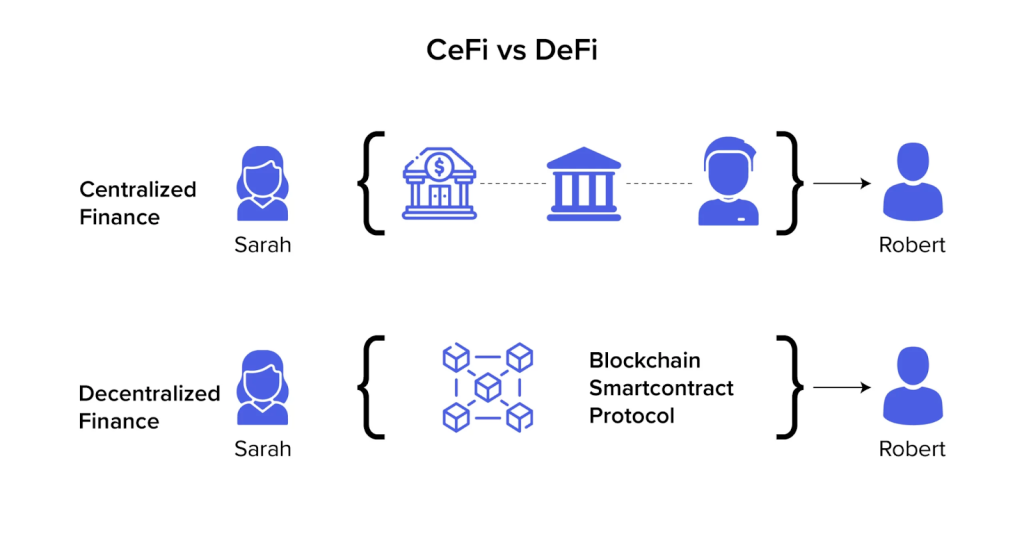

1. DeFi (Decentralized Finance)

You must’ve noticed Decentralized Finance (DeFi) has rapidly evolved, disrupting traditional financial systems by removing middlemen like banks. I find it interesting that DeFi platforms like Aave and Compound offer decentralized lending and borrowing, where users earn interest or take out loans directly with cryptocurrencies. Aave’s “Flash Loans” allow users to borrow assets without collateral for brief periods, showcasing DeFi’s innovative edge.

To explain the magnitude of this movement, in 2024 alone the DeFi sector has witnessed remarkable growth, with the total value locked (TVL) exceeding $50 billion. This demonstrates how DeFi has moved from niche to mainstream, providing real-world utility and expanding financial access globally.

Read more about DeFi and how Web3 regulations are influencing DeFi around the world here.

2. Tokenized Assets

One of the most revolutionary concepts to me was Asset Tokenization, i.e., transforming asset management by converting physical and digital assets into blockchain-based tokens, making them more accessible and liquid. For instance, RealT has pioneered the tokenization of real estate, allowing fractional ownership of properties. An apartment in Detroit was divided into tokens, enabling smaller investors to buy shares of the property.

Similarly, CurioInvest has tokenized luxury cars and art, offering fractional investments in high-value assets. This approach lowers the entry barrier for investors and enhances liquidity, allowing assets to be traded more freely. If this is not impressive enough already, the market for tokenized assets is projected to reach $300 billion by 2025. Now is the time for your business to leverage tokenized assets for your benefit, riding the wave early to capture your market. Read here to know how, along with how to overcome the challenges while implementing it.

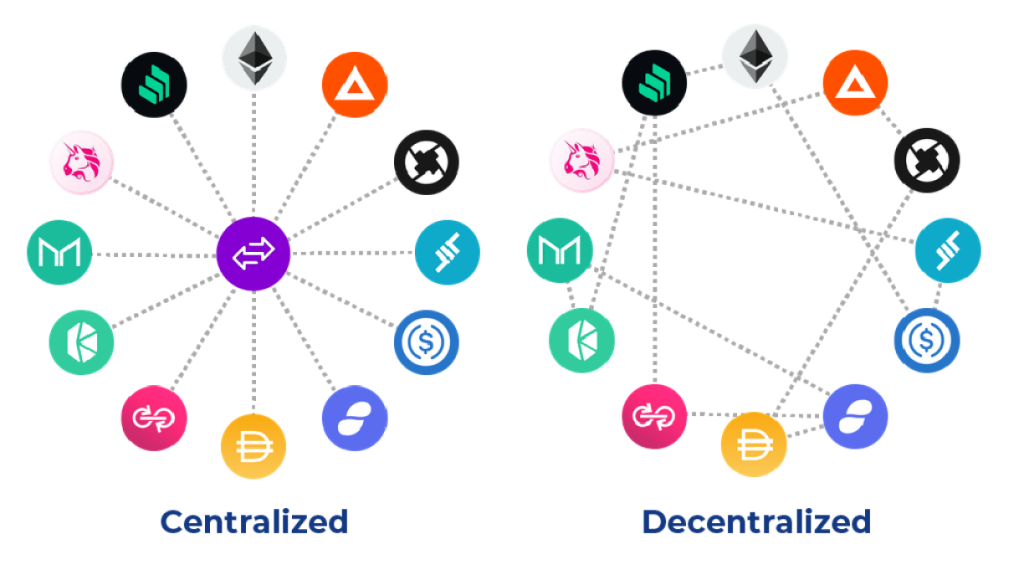

4. DEX or Decentralized Exchanges

I also want to highlight how DEXs are revolutionizing the way we trade digital assets by facilitating peer-to-peer transactions without intermediaries. This means you can trade directly with other users, enhancing both efficiency and security.

Let me share examples of SushiSwap and PancakeSwap, which are prominent DEXs that use smart contracts for trading, ensuring transparency and security. Recently, SushiSwap integrated tokenized stocks, allowing users to trade shares of traditional companies directly on the blockchain imagine buying a fraction of a stock using cryptocurrency!

If you’re dilemmatic, then let me tell you that the future looks bright for DEXs seeing how as of 2024, SushiSwap has attracted over 500,000 active wallets. While on the other hand, Uniswap handles billions in daily trading volume and has millions of active users. These platforms significantly reduce trading costs and time delays compared to traditional exchanges, proving their efficiency and appeal. Hence there is not a reason why several users wouldn’t be preferring and switching to DEXs.

5. Global Payments & Security

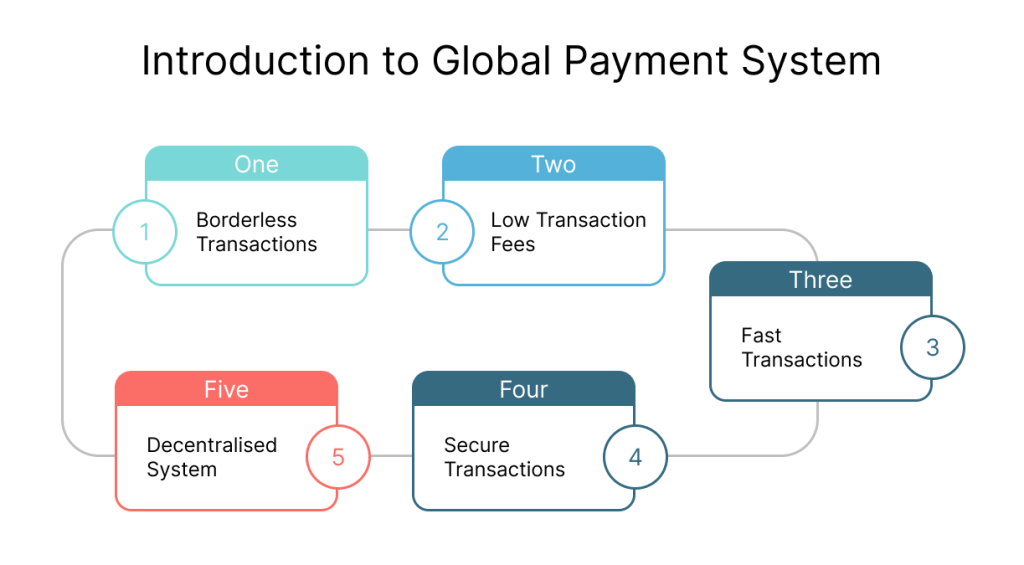

Let’s be real, we’ve all seen it – traditional banks have historically found it difficult to execute cross-border payments because of the high costs, lengthy processing periods, and large number of middlemen involved. Who would want to pay a substantial amount of money, and wait for weeks to make the payment, when you can get it done instantly and affordably? And how sure are we about the security of our transactions?

Web3 is bringing about that change. Blockchain technology makes cross-border transactions inexpensive, instantaneous and very secure. Digital currencies can be transmitted securely at any time, anywhere in the world, without going through banks or other middlemen.

Chainalysis reports that DeFi transactions now represent a substantial share of global cryptocurrency activity, reflecting its growing acceptance and integration into the financial landscape. According to the 2024 Global Crypto Adoption Index by Chainalysis, the Central & Southern Asia and Oceania region dominates the Top 20 countries that are adopting crypto globally. Leading with India with the highest overall index, followed by countries like the USA, Russia, Nigeria, UK, Philippines and more.

The report also states that between the fourth quarter of 2023 and the first quarter of 2024, the total value of global crypto activity increased substantially, reaching higher levels than those of 2021 during the crypto bull market.

Interesting to note is that Last year, growth in crypto adoption was driven primarily by lower-middle income countries. This year, however, crypto activity increased across countries of all income brackets, with a pullback in high income countries since the beginning of 2024.

Whats Next?

The best course of action for your business would be to start planning a transformation into Web3. The benefits and experience with Web3 is unparalleled. Decentralization, user control, minimal fees, global connectivity, transparency, security, greater liquidity, eliminating middlemen and brokers, and I could just go on and on listing the unmatched potential that Web3 offers.

Stay ahead of the wave, and join the Web3 revolution now. While Web2 brought unprecedented success and connectivity, the time has come for a transformative leap forward. Web3 is sweeping in an era of more ownership, privacy, user control and transparency. By embracing Web3 today, you position yourself at the cutting edge of technology – as an organization that drives the future of the internet.

Connect with our experts at Kreatorverse who have successfully transitioned renowned fintechs into the realm of Web3, offering support round-the-clock and dedicated to ensure your business is not just successful, but thrives.