The benefits of DeFi are tremendous, and these advantages are felt across industries. And while many want to jump onto the DeFi bandwagon, it is important to understand where on the readiness scale your company stands. Here’s a guide to understanding DeFi, the blockchain technology that powers it, how it plays within Web3’s core tenets, and whether your organization or startup can build the technology in-house, or it may need help from a venture studio.

Imagine a world where financial transactions are seamless, secure, and truly decentralized – where traditional intermediaries are no longer necessary, and individuals have complete control over their assets. This is the promise of Decentralized Finance (DeFi), a rapidly evolving ecosystem that leverages blockchain technology to revolutionize how we access and manage financial services.

What makes us so confident that DeFi will be truly revolutionary? Well, here’s what:

Deloitte conducted a survey where they collected responses from executives and pioneers of the financial service industry to gauge their perspectives on blockchain technology, digital assets, and cryptocurrencies. Here’s what they think:

| 97% believe that their organization will lose an opportunity for competitive advantage if they don’t adopt blockchain and digital assets. |

| 93% agree that there is a compelling business case for using blockchain, digital assets, and cryptocurrencies within their organization. |

| 96% agree that the financial industry will see new revenue streams from blockchain, digital assets, and cryptocurrency solutions |

It is clear. The potential of DeFi and blockchain technology is widely recognized within the financial sector. Most have already acknowledged the need to embrace these innovations to maintain a competitive edge and unlock new revenue streams.

So, as DeFi continues to expand – building advanced, differentiated DeFi assets for consumers and investors is a strategic imperative for those who want to remain competitive and future-proof their offerings.

However, venturing into the DeFi realm requires careful assessment and preparation, which will help financial institutions successfully transition into decentralized finance.

Understanding DeFi: A Primer

Before delving into the intricacies of technological readiness, it is essential to understand the fundamental principles and components that underpin the DeFi ecosystem.

DeFi is built upon a decentralized, permissionless, and trustless infrastructure. Financial services are facilitated through a network of blockchain protocols, smart contracts, and decentralized applications (dApps). Unlike traditional finance, DeFi eliminates the need for intermediaries, enabling individuals to retain complete control over their assets and transactions.

At the core of DeFi lies the blockchain technology, which serves as the immutable and transparent ledger for recording and verifying transactions. Digital assets, such as cryptocurrencies and tokenized assets, act as the building blocks for DeFi protocols, enabling peer-to-peer value exchange and the creation of innovative financial instruments.

How is DeFi different from CeFi and TradFi?

To fully grasp the significance of DeFi, it’s crucial to understand how it differs from traditional finance (TradFi) and centralized finance (CeFi):

- TradFi refers to the traditional financial system, where transactions are facilitated by centralized intermediaries such as banks, brokers, and exchanges.

- CeFi involves centralized crypto platforms that mimic traditional financial services but operate within the crypto ecosystem, still relying on intermediaries.

- DeFi, on the other hand, eliminates the need for intermediaries by leveraging blockchain technology and smart contracts. This decentralized approach enables permissionless, trustless, and transparent financial transactions, enhances security, reduces costs, and promotes financial inclusion.

By eliminating intermediaries and embracing decentralization, DeFi offers a paradigm shift in accessing and managing financial services, empowering individuals and organizations with greater control, transparency, and accessibility.

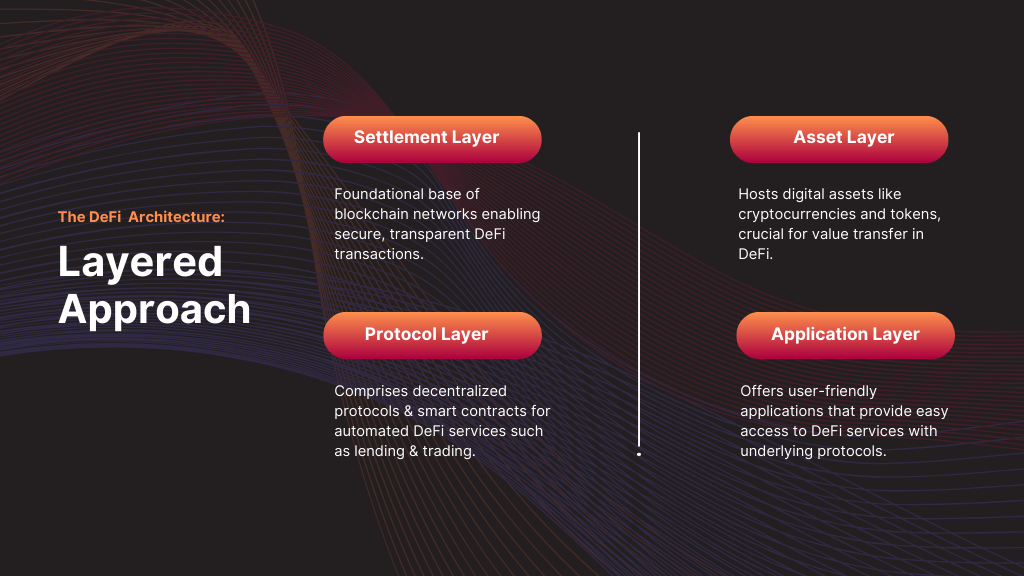

The DeFi Technology Guide: A Layered Architecture

To fully comprehend the technological readiness required for DeFi adoption, it is crucial to understand the multi-layered architecture that underpins this ecosystem. Each layer serves a distinct purpose and collectively forms the foundation for building advanced DeFi applications.

- Settlement Layer: This foundational layer consists of blockchain networks like Ethereum, which provide the underlying infrastructure for DeFi applications and enable secure and transparent transaction processing.

- Asset Layer: This layer encompasses digital assets, such as cryptocurrencies (e.g., Ether, Bitcoin) and tokenized assets (e.g., stablecoins, NFTs), which serve as the building blocks for DeFi protocols and enable the representation and transfer of value within the ecosystem.

- Protocol Layer: At the heart of DeFi lies the protocol layer, comprising decentralized protocols and smart contracts that enable various financial services, including lending, borrowing, trading, and asset management. These protocols leverage blockchain technology and smart contracts to automate and govern financial transactions, eliminating the need for intermediaries.

- Application Layer: The application layer consists of user-friendly interfaces and applications that interact with the underlying protocols, allowing users to access and utilize DeFi services seamlessly. These applications serve as the entry point for individuals and organizations to engage with the DeFi ecosystem.

A deep understanding of the DeFi technology architecture can help you identify potential bottlenecks, compatibility issues, and areas requiring upgrades or modifications.

This knowledge will serve as a blueprint for developing a strategic roadmap to ensure a seamless transition into the DeFi realm. It will enable the creation of innovative and differentiated DeFi assets that meet the evolving needs of consumers and investors.

Assessing Technological Readiness for FIs

The path to building advanced differentiated DeFi assets begins with deeply introspecting your organization’s technological capabilities.

Building advanced DeFi assets requires a robust technological foundation and a deep understanding of the Web3 stack. This foundational layer is crucial for seamlessly integrating blockchain technology, smart contracts, and decentralized applications (dApps) into your offering. Use the below framework to assess and strengthen your technological readiness:

Infrastructure Compatibility Assessment:

- Conduct a detailed audit of your current technology infrastructure, including hardware, software, and network capabilities.

- Evaluate the compatibility of your systems with blockchain technology, smart contract platforms, and decentralized application frameworks.

- Identify potential bottlenecks, scalability issues, or compatibility challenges that must be addressed.

Technology Partnerships and Collaborations:

- Explore trusted Web3 innovation partners to augment your technological capabilities and gain access to specialized expertise.

- Leverage these collaborations to stay ahead of emerging trends, leverage best practices, and accelerate your DeFi product development lifecycle.

Continuous Innovation and Experimentation:

- Foster a culture of continuous innovation and experimentation within your technology teams, encouraging them to explore new techniques, tools, and frameworks.

- Allocate dedicated resources for research and development, proof-of-concept projects, and testing cutting-edge DeFi solutions.

- Establish feedback loops and mechanisms to incorporate experiment learnings into your product roadmap and technology strategy.

Recognizing the importance of technological readiness early on and investing in it to strengthen it will allow you to rapidly develop cutting-edge DeFi products and establish a strong foothold in the market.

What disruptive models can you build with DeFi?

Once startup founders establish the necessary technological readiness, they can create disruptive models that redefine the boundaries of the DeFi ecosystem.

The decentralized nature of DeFi, coupled with the power of blockchain technology, opens up a world of possibilities for entrepreneurs to explore and push the limits of what’s possible in finance.

These aren’t mere iterations of existing solutions but game-changing models that challenge traditional paradigms and democratize access to financial services. Some examples of disruptive DeFi models include:

Decentralized Exchanges (DEXs)

One of the most transformative disruptive models in the DeFi landscape is the rise of Decentralized Exchanges (DEXs). These peer-to-peer platforms enable trustless trading of digital assets without the need for intermediaries, providing enhanced security, transparency, and cost-efficiency.

By leveraging blockchain technology and smart contracts, DEXs eliminate the need for centralized entities, empowering users with greater control over their assets and minimizing the risks associated with centralized exchanges, such as hacking, censorship, and market manipulation.

A prime example is Uniswap, which has facilitated over $1 trillion in trading volume since its launch. It allows users to trade cryptocurrencies through an automated market maker model and liquidity pools, demonstrating the immense demand for decentralized trading solutions.

Decentralized Lending and Borrowing Platforms

Another groundbreaking innovation is the advent of Decentralized Lending and Borrowing Platforms. These platforms facilitate peer-to-peer lending and borrowing of digital assets through smart contracts, which handle collateralization and interest rate determination.

By removing the need for traditional financial institutions, these platforms foster financial inclusivity, providing access to credit and investment opportunities to individuals and businesses traditionally underserved or excluded from the conventional financial system.

Aave, one of the most prominent DeFi protocols with over $10 billion in total value locked, has demonstrated the potential of such platforms to provide financial services to a global audience by enabling users to lend and borrow various cryptocurrencies without intermediaries.

Decentralized Asset Management

Decentralized Asset Management platforms are revolutionizing the industry by enabling the creation and management of tokenized investment portfolios. These platforms leverage the power of blockchain technology for transparency and automation, offering a level of accessibility and control previously unattainable in traditional asset management practices.

Investors can now participate in diversified portfolios, track their investments in real time, and enjoy unprecedented transparency regarding fees, performance, and asset allocation.

Set Protocol has capitalized on this opportunity by facilitating the launch of tokenized portfolios called “Sets,” allowing investors to gain exposure to diversified crypto assets with increased transparency.

Their vault has grown from $500,000 locked to $24 million in just over a year, and the cumulative rebalance volume sits at over $100 million. This demonstrates the significant demand for decentralized asset management solutions.

Decentralized Stablecoins

Decentralized Stablecoins are bridging the gap between traditional and decentralized finance by providing a stable digital asset pegged to fiat currencies or other assets. These cryptocurrencies offer the stability and familiarity of conventional currencies while enabling seamless value transfer within the DeFi ecosystem.

Stablecoins are an indispensable component of the DeFi infrastructure. They facilitate transactions, lending, borrowing, and other financial activities without the volatility associated with other cryptocurrencies.

MakerDAO’s DAI stablecoin, with a market capitalization of over $5 billion, is a prime example of a decentralized stablecoin that has gained widespread adoption, highlighting the demand for stable digital assets that can facilitate transactions, lending, borrowing, and other financial activities without the volatility associated with other cryptocurrencies.

Decentralized Insurance

Decentralized Insurance protocols democratize access to insurance services by enabling risk-sharing and coverage against various events, such as smart contract failures or asset loss. Through pooled funds and automated payouts, these protocols offer a transparent, secure, and cost-effective alternative to traditional insurance models.

By leveraging blockchain technology, Decentralized Insurance protocols eliminate the need for intermediaries, reduce overhead costs, and provide a seamless claims process, making insurance accessible to more individuals and businesses.

Nexus Mutual has demonstrated the viability of this model by providing coverage for crypto-related risks and processing over $18 million in claims payouts, making insurance more accessible to individuals and businesses in the crypto space.

Navigating the DeFi landscape is a complex and multifaceted journey, but the rewards for those who embrace it are immense. By thoroughly assessing your organization’s technological readiness at all levels, you can identify strengths, weaknesses, and gaps and develop a strategic roadmap for successful DeFi adoption.

Venturing into the DeFi space requires significant resources, which must also be strategically allocated to avoid potential pitfalls, such as undercapitalization or misalignment with business objectives.

At Kreatorverse, we understand the challenges and opportunities that the DeFi presents. Our team of Web3 experts specializes in guiding startups through this transformative process, from readiness assessment to product design, development, and ongoing maintenance.

FAQs

1. What is DeFi, and how is it different from traditional finance?

DeFi offers financial services like lending, trading, and investing on blockchain networks without banks. This enables peer-to-peer transactions, unlike traditional finance, which depends on centralized institutions and intermediaries.

2. What tools do I need to start using DeFi platforms?

To start using DeFi, you need a crypto wallet (like MetaMask), some cryptocurrency (like ETH), access to a DeFi platform (like Uniswap), and strong security practices.

3. Is DeFi regulated?

DeFi is mostly unregulated and operates on decentralized networks without central control. However, governments are exploring ways to regulate it to protect users and prevent illegal activities.

We’re the trusted Web3 Venture Studio and Innovation Partner.

Financial enterprises and startups across the globe trust Kreatorverse

for all things deFi, blockchain, and digital transformation.