In global commerce, trade financing is the backbone that keeps the wheels of international trade turning smoothly. Trade financing refers to financial instruments and products that facilitate international trade and commerce. It ensures that exporters receive payment promptly, and importers obtain the necessary goods, effectively bridging the gap between the supply chain and financial systems.

Trade financing dates back to ancient civilizations, where merchants relied on credit and barter systems to conduct business. Over time, it has evolved into a complex financial ecosystem, encompassing various instruments like letters of credit, trade credit insurance, and export financing. Today, the trade finance market is immense, with an estimated value of over $10 trillion in 2023, according to the World Trade Organization (WTO).

About Polytrade

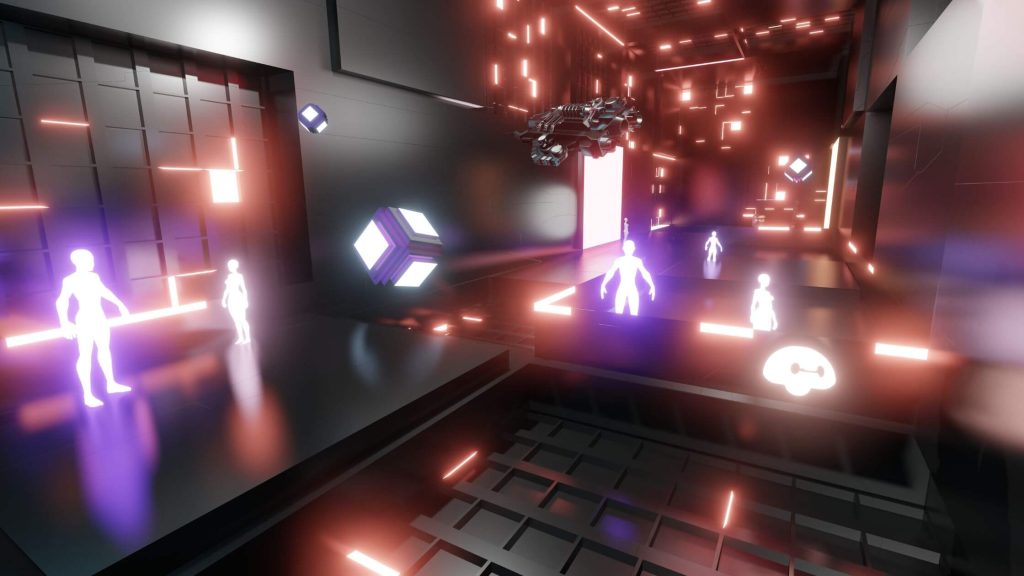

Polytrade is a real-world asset (RWA) marketplace for trade finance, equities, T-bills, and more. The company is at the forefront of creating an inclusive, efficient, diversified investment landscape, ensuring secure, seamless transactions and enabling secondary liquidity across multiple blockchain ecosystems.

Polytrade’s platform empowers users to tokenize, discover, and trade various RWA-tokenized asset classes, from trade finance to equities and bonds, by leveraging the benefits of asset tokenization standard ERC 6960, such as fractional ownership and global investment access.

The Opportunity: Trade Invoice Tokenization

Traditionally, large banks and lending institutions have controlled trade financing — with the bulk of the capital going to mammoth-sized trading houses. This leaves small-to-mid-sized exporters largely underserved. In some developed countries, up to a third of SMEs face this challenge, according to WTO.

“SMEs in developing countries face even greater challenges in accessing trade finance. The estimated value of unmet demand for trade finance in Africa is US$ 120 billion (one-third of the continent’s trade finance market) and US$ 700 billion in developing Asia.”

Trade finance and SMEs, World Trade Organization

Polytrade wanted to disrupt the trade financing market by addressing the above gap. By allowing crypto natives to invest in tokenized trade invoices and earn an annual yield in stablecoins, trade finance could democratized.

The Challenge for Polytrade

In 2022, Polytrade did not possess the in-house engineering expertise to design and develop decentralized finance applications.

To bring their idea to life, Polytrade needed a team of skilled blockchain engineers and decentralized application (dApp) developers with proven experience in blockchain protocols and regulatory compliance.

The mandate also required time and cost efficiencies, while avoiding wasteful trial and error.

The Solution: A Strategic Partnership with Kreatorverse

An early-stage investor recommended Polytrade work with Kreatorverse, based on our experience and proven success in Web2-to-Web-3 transformation across various protocols – Hyperledger Fabric, Polygon, Ethereum, and more.

Polytrade tapped our Web3-as-a-Service expertise in:

- Rapid UI Development: Kreatorverse deployed a market-tested Web3 dApp frontend development framework based on Reactjs &Nextjs, to craft Polytrade’s UI into pixel-perfect precision.

- Responsive Design: We deployed the latest tech stack and undertook extensive testing, to optimize app responsiveness across major devices.

- Blockchain Frontend Development: We integrated blockchain functionality into the application’s front end for smooth user interactions and seamless data sync with the blockchain network.

The Outcome

The Kreatorverse team worked with Polytrade for 6 months and delivered a seamless front-end UI.

The new Polytrade ‘Web3 experience’ has a lender portal for crypto investors to connect their wallets and lend funds to trade finance borrowers while earning high yields in widely accepted stablecoins like USDT or USDC.

We reduced time-to-market with a minimum viable product (MVP) ready within 3 months, thanks to our extensive experience in dApp development. Wasteful trials and errors were avoided.

With our Web3-as-a-Service offering of tailored product strategy, pixel-perfect design, superior product development, and managed go-to-market (GTM), we ensured zero failure, even at scale.

Polytrade x Kreatorverse: Continuing Partnership

As a result of the successful launch of their trade finance invoice tokenization product, Polytrade secured $3.8 million in seed funding led by leading Web3 investors – Alpha Wave, Matrix Partners, Polygon Ventures, and CoinSwitch Ventures. Other notable investors include Singularity Ventures and GTM Ventures.

Currently, we’re working with Polytrade on their new product line – digital assets marketplace. This is intended to be an aggregation platform—much like how OpenSea is a Web3 marketplace for NFTs and crypto collectibles—except that Polytrade will focus on real-world assets.

Polytrade continues to tap our strengths, as we:

- Deliver a pixel-perfect front-end development and experience

- Develop a reliable backend server for the marketplace to scale on demand

Web2-to-Web3 Transformation made Easy

At Kreatorverse, we pride ourselves on delivering success stories for our co-creators like Polytrade. Our blockchain engineering experience spans 30+ Web3 innovation projects across Financial Services, Supply Chain, Social Networking, Hospitality, Education, Sports, and other industries.

Leverage our proven expertise and experience in building DeFi apps, blockchain solutions, and digital asset infrastructure, to launch your industry-disrupting idea.